To: Florida Realtors & Real Estate Professionals

From: The Desk of Rafael Fabian

Date: January 8, 2026

Subject: Reminder – March 1, 2026 Deadline for New Homestead Exemption Applications

Memo to Real Estate Professionals

Important Deadline for Florida Homestead Exemption

What You Need to Know

- Deadline: March 1, 2026 (some counties list March 2 when March 1 falls on a weekend/holiday).

- Who Qualifies: Clients who made Florida their permanent residence by January 1, 2026 and purchased their property on or before December 31, 2025.

Why This Matters for Your Clients

- Immediate Tax Savings – up to $50,000 reduction in assessed value

- First $25,000 applies to all taxing authorities (including schools).

- Next $25,000 applies to non-school taxes on property values between $50,000 and $75,000.

- Assessment Cap Protection – “Save Our Homes”

- Limits annual assessed value increases to 3% or CPI, whichever is lower; protects long-term homeowners from dramatic tax hikes.

- Portability of Savings

- Allows transfer of accumulated Save Our Homes assessment difference to a new Florida homestead.

- Additional Perks

- Additional exemptions for seniors, veterans, disabled individuals, and surviving spouses

- Legal protections for the homestead against most unsecured creditors (not applicable to mortgages, property taxes, HOA liens, or IRS debts).

How to Help Clients Apply

- Confirm the client held legal title and declared Florida residency by January 1, 2026.

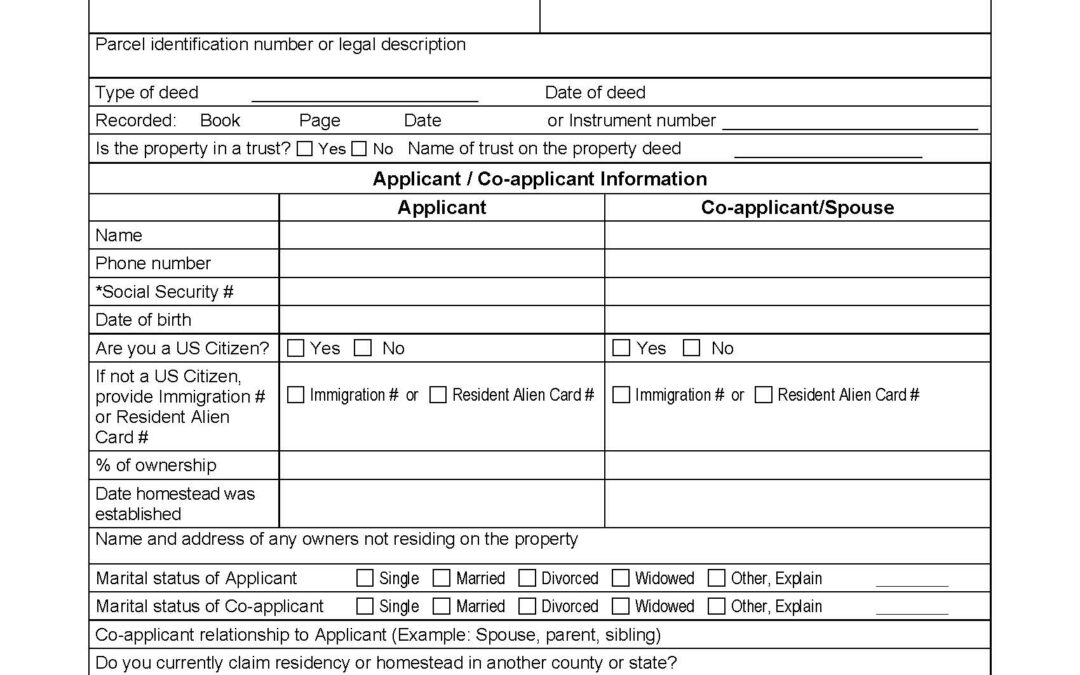

- Complete Form DR-501 (ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS) and gather required documents: Florida Driver License/ID with homestead address, proof of ownership (deed/title), Social Security numbers for all owners and spouses, and supporting documents (e.g., voter/vehicle registration, utility bills, Declaration of Domicile).

- Submit to the County Property Appraiser’s office by March 1, 2026—online, by mail, or in person depending on the county.

- Once approved, remind clients that most exemptions renew automatically annually (unless ownership or use changes).

Take Action Now

- Alert qualifying buyers and recent purchasers immediately about the deadline.

- Share county-specific Property Appraiser links and filing instructions.

- Offer assistance in gathering documents and verifying eligibility.